Industry Demand Report – January 2026

A Year of Moderation. A Year of Pricing Strength.

As healthcare organizations step into a new year, the labor market is offering something leaders rarely get: clarity.

By the end of 2025, utilization had cooled. Requisition volumes declined, particularly in nursing, and the urgency that defined prior cycles gave way to more disciplined, needs-based hiring.

But the relief many expected never arrived.

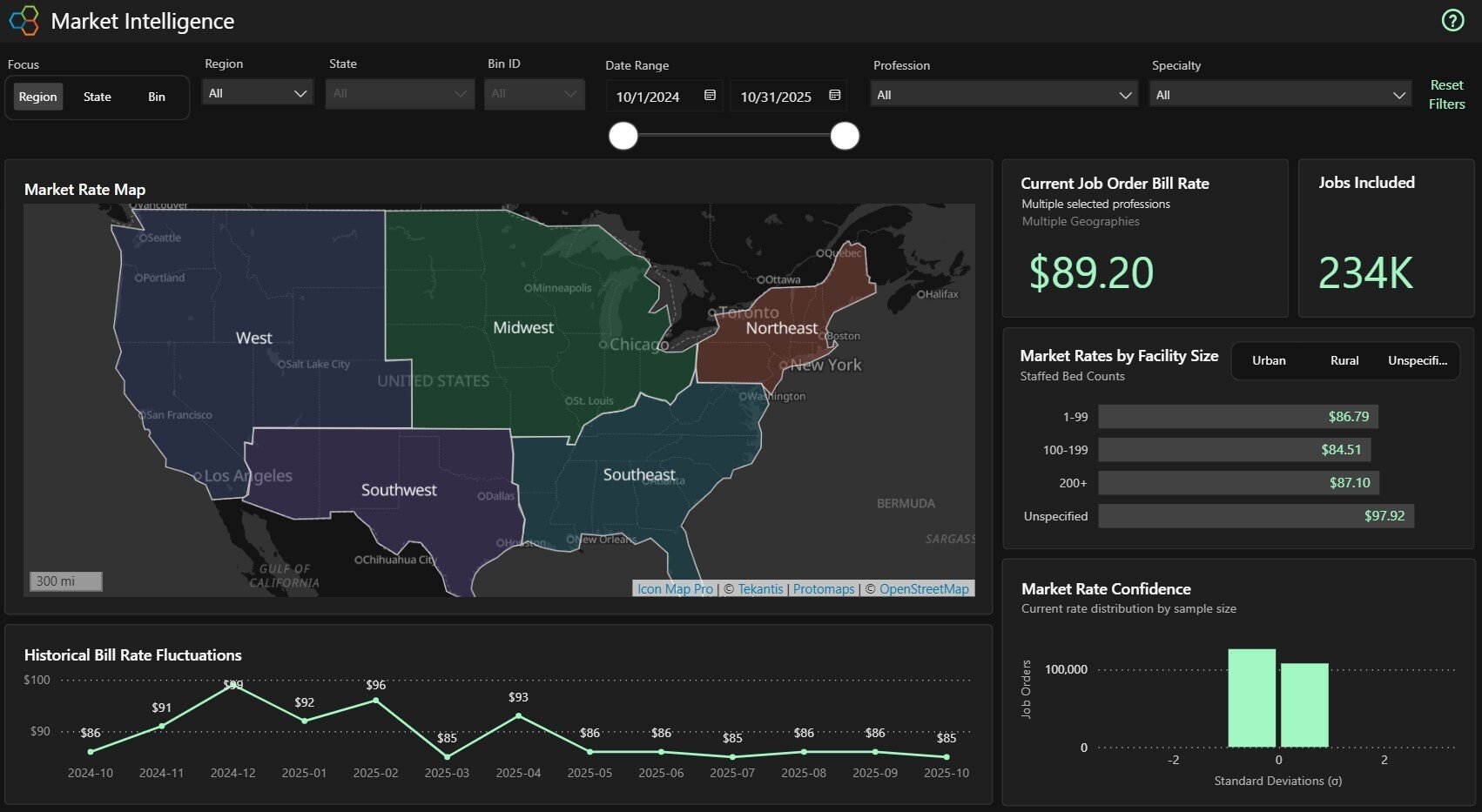

Bill rates across both nursing and allied health held firm through the second half of the year, anchored in the mid-$80s and supported by ongoing scarcity of experienced clinicians. Even as orders pulled back, competition for talent remained concentrated in the markets where access has always been hardest.

The signal from the data is unmistakable.

Normalization in volume is not translating into compression in price.

-

So, what should healthcare leaders take from a full year of evidence?

-

Where did behavior truly change?

-

Where did it refuse to move?

-

And what does that mean for budgeting and workforce strategy in 2026?

The January Industry Demand Report delivers those answers, combining monthly signals with quarterly and full-year perspectives to confirm which dynamics are temporary and which are structural.

Why the January Demand Report Carries More Weight

This report closes the book on 2025.

Instead of reacting to short-term movement, leaders can now evaluate trends across weekly, monthly, quarterly, and multi-year views. The consistency across those time horizons reinforces confidence in where the market is headed next.

The takeaway: volatility has eased, but constraint remains.

What the Data Shows

Nursing:

Nursing volumes stepped down progressively throughout the year, with the sharpest pullbacks arriving in Q4. Yet after a midyear reset, pricing held steady through year-end. High-acuity and talent-constrained states continued to command premium behavior, underscoring that dependency on contingent labor remains firmly embedded.

Allied Health:

Allied once again proved to be the stabilizer. Demand fluctuated within a narrow range, and bill rates showed minimal year-over-year movement. Utilization continues to be driven by procedural and diagnostics-based roles, offering predictability but little downward price momentum.

The Bigger Picture:

Across the entire market, geography intensified as the defining variable. National averages increasingly mask localized exposure, particularly for multi-state systems balancing uneven coverage risk.

This is a more disciplined market, not an easier one.

Get the Full Story: Download the January Industry Demand Report

Inside, healthcare executives and workforce leaders will find:

-

Verified month-over-month changes in open orders and bill rates

-

Quarter-end comparisons that highlight where momentum shifted

-

Full-year perspective on utilization versus price behavior

-

Four-year lookbacks that distinguish cyclical moves from structural change

-

Market-by-market insights into where cost exposure is compounding

-

Practical expectations for how these patterns carry into early 2026

As organizations move from reflection to execution, leaders who plan at the market level, not the national level, will be best positioned to manage spend and secure coverage.

Download the January Industry Demand Report and equip your team with the validated intelligence needed to navigate a workforce environment defined by stability, scarcity, and geographic risk.

Trevor Strauss

Trevor Strauss